After a year of economic uncertainty amid U.S. President Donald Trump’s trade war on Canada, B.C.’s annual budget for 2026 emphasizes “discipline” by reducing government spending, and investing in what it considers critical services.

But in spite of the goal of prudence, the three-year fiscal plan forecasts B.C.’s deficit will reach more than $13-billion this year.

CLICK HERE TO LISTEN TO 1130 NEWSRADIO VANCOUVER LIVE!

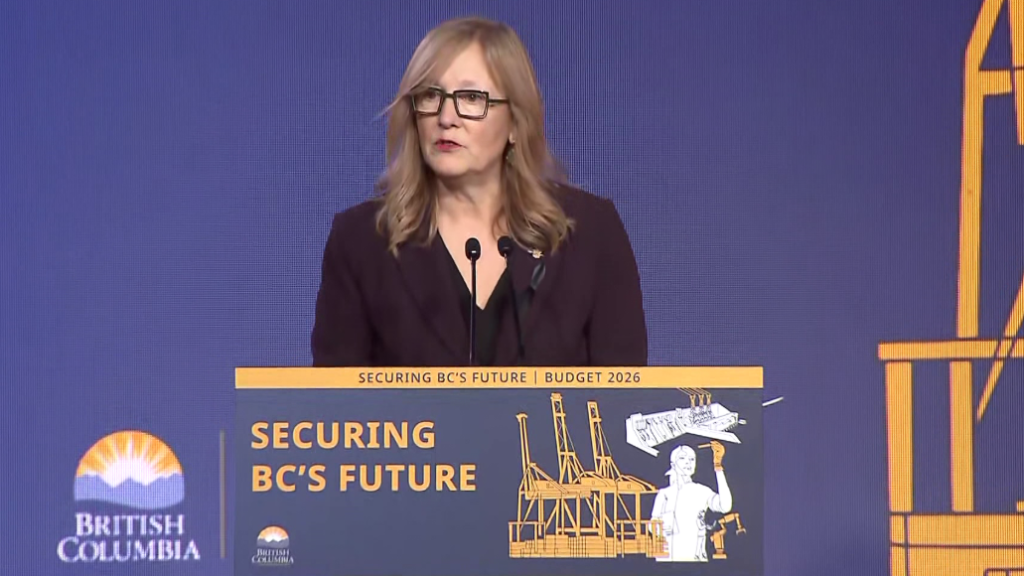

The budget, presented in Victoria Tuesday afternoon, titled ‘Securing B.C.‘s Future,’ proposes a future with a significantly reduced public sector, bolstered health-care services and education, extended timelines to complete major capital projects, and benefits to attract skilled workers and natural resource projects in the province.

B.C. Finance Minister Brenda Bailey pitched the document as a “serious budget for very serious times.”

Bailey began her presentation Tuesday by reflecting on the mass shooting in the northeastern B.C. community of Tumbler Ridge only one week ago.

“As out of sync as it feels to talk about or work on anything else, we must,” said Bailey.

“We will continue our work, but we will do so with the people of Tumbler Ridge in our hearts.”

This fiscal year, B.C.’s deficit is expected to reach $13.3 billion – the highest it has ever been.

The deficit will rise in spite of what Bailey calls ‘careful choices’ in the three-year fiscal plan, including a reduction in the public sector workforce, a re-pacing of the capital plan, and an increase in some taxes to bolster government revenue.

Bailey says ‘careful, difficult spending choices’ will work to push the deficit down over the three-year plan to a projected $11.4 billion in 2028/29.

The forecasts remain significantly higher than projected in last year’s budget. Budget 2025 forecasts a deficit of $10.9 billion for 2025-26, $10.2 billion for 2026-27, and $9.9 billion for 2027-28.

Meanwhile, taxpayer debt is also expected to jump in 2026, with the debt-to-GDP ratio expected to exceed 30 per cent this year, up from 26.1 per cent for 2025/26, before spiking to 34.4 per cent in 2027 and 37.4 per cent in 2028.

Bailey said the good news is that this year’s deficit has come in lower than expected. The third quarter of the 2025/26 fiscal year puts the provincial deficit at $9.6 billion, down from the nearly $11 billion originally projected in last year’s budget.

To raise B.C.’s revenues, Budget 2026 reveals that some taxes will increase.

While the income tax rate for the lowest bracket rises from 5.06 per cent to 5.6 per cent, the average taxpayer in B.C., it says, will pay $76 more in 2026.

The province argues that the cost will be offset for more than 40 per cent of taxpayers who qualify for the B.C. tax reduction credit.

“Those in the lowest bracket will come out ahead,” Bailey claimed.

For owners of a property valued between $3 million and $4 million, the Additional School Tax rate will increase from 0.2 per cent to 0.3 per cent.

The budget says B.C. will remove Provincial Services Tax (PST) exemptions from some goods and services – such as accounting and bookkeeping services – and expand the tax base to some others – such as services related to clothing and footwear, basic cable television and land-line phone services.

“Expanding the tax to these services is generally consistent with how tax applies to these

services in most provinces.”

The minister says the budget was developed in a time of “fundamental change,” citing the coincidence of last year’s budget presentation on the same day that the U.S. implemented the first of its new tariffs on Canadian goods.

“We’ve seen a flurry of both words and actions from President Trump that once seemed truly unimaginable from our closest ally,” said Bailey, adding that the trade war has “changed the world order irrevocably.”

While the province is expected to reach a record-high deficit of $13.309 billion in 2026, Bailey says the budget presents a measured response rather than a reaction.

“I want to be clear: this is not an austerity budget.”

Bailey says the budget reflects careful choices to protect services over “nostalgia” for a better economic time.

The minister says the 2026 budget will force the government to pause on “some of the things that we want to do, and focus on the things that we have to do.”

Dominating the province’s “protective” focus this year is an investment in health, mental health, and child-care services.

Budget 2026 introduces $2.8 billion in new funding for B.C.’s health-care system over three years.

The new investments include $131 million for mental health and addictions treatment, with the ministry noting increasing spaces for involuntary care; $34 million to provide access to in-vitro fertilization (IVF) for “almost 1,800” British Columbians; and, most significantly, $2.3 billion towards increasing the health-care system’s overall capacity.

Bailey boasted previous investments that have shortened wait times for diagnostics and brought in more than 1,000 doctors.

“At the same time, we know that there is work ahead. Not everyone in B.C. has a family doctor yet,” she admitted.

The budget explains that its capacity investments includes hiring more doctors, nurses and health-care workers, and expanding operations and facilities across the province.

Announced last week, the budget also includes $457 million toward a restructured system of supporting children and youth with disabilities.

Another $478 million will go toward supporting children and youth in alternative care, $373 million toward income and disability assistance for adults, and $5 million for improved disability assistance for couples.

B.C.’s K-12 education sector is also set to improve through new funding, with an investment of $634 million dollars over three years, which the province says will help hire new teachers, improve student services, and support inclusive learning.

Bailey says more teachers, special-education teachers, teacher psychologists and counselors will be able to help more young people in the classroom.

After hearing concerns about equity from child-care service operators, the province says it will pause enrolment of new providers to the $10-a-day child care program during what it calls a “stabilization” period.

“Families and providers currently in the $10-a-day program will see no changes,” budget documents add.

The province has also budgeted $139 million over three years to address public safety.

Bailey says the investment continues the work of “taking action on all fronts” to make B.C. communities safer.

Of the total, she says $73 million will be used to help improve access to justice and court operations, through retaining and hiring new sheriffs, Crown counsel, legal aids and employees of the BC Prosecution service.

B.C.’s Repeat Violent Offending Intervention Initiative, the budget says, will receive $26 million after early evaluations show it has resulted in fewer police interactions and faster charge approvals for high-risk offenders.

Meanwhile, the province will also spend $16 million on a new program, the Chronic Property Offending Intervention Initiative, focused on enforcement of crimes such as vandalism and shoplifting.

Baily says the province is “taking decisive action to confront the rise in extortion south of the Fraser [River],” by coordinating police jurisdiction through its BC Extortion Task Force and securing federal support.

“At the same time as we invest in our critical services,” Bailey said, “Our government is focused on growing our economy.”

Budget 2026 has allotted $758 million over three years to that goal.

As Bailey explains, “training people for good jobs is essential to building a strong economy,” the funding includes $241 million to “double” what SkilledTradesBC currently receives.

“This funding will address wait-lists for most in-demand trades, increase perceived funding, and continue the expansion of skilled trade certification,” said Bailey.

B.C. is forecasting slow to moderate economic growth over the next two years, but is pushing forward on its ‘Look West’ strategy with funding commitments to bolster the province’s skilled trades workforce.

Of the $758 million, $400 million of the total will be used in a fund to secure, and match or bolster federal funding.

“The account will be used to attract investment that builds on B.C.’s strength in clean energy, value-added forestry, manufacturing, responsible mining, life sciences, AI, quantum, our marine sector, and aerospace, and clean technology,” Bailey explained.

The budget also outlines $40 million to reduce barriers to permits for businesses in the natural resource and tourism sectors.

While protecting critical services, the province says it will make deep cuts to the public sector.

“As part of its commitment to expenditure management targets announced at Budget 2025, government has reduced spending by $400 million for 2025-26 through staffing adjustments, hiring restrictions, and reducing discretionary spending by reviewing travel, consulting contracts, office and business expenses,” Budget 2026 documents explain.

The budget says it will work to reduce the public sector by 15,000 full-time jobs.

“As part of the reductions in the public sector, government will be developing specific targets to reduce the number of executive positions, with a focus on Crown corporations and the health sector.”

It says the province hopes to achieve reductions in its core government services through attrition and voluntary departures as much as possible.

With “prudency” in mind, Budget 2026 outlines new timelines for its capital plan.

Bailey says strategic restrictions will help B.C. respond to things it cannot control, such as the price of steel.

“In addition, the ongoing trade war and tariff threats continue to drive global instability,” Budget 2026 says.

“Material and labour costs have remained persistently high. These create conditions where government must make careful choices on its capital plan in the long term.”

Budget 2026 includes provisions to ‘strategically sequence’ the construction of several major projects across the education, health, and long-term care sectors as a result.

For instance, the province says the Burnaby Hospital Redevelopment project will be reassessed before it moves to Phase 2 of construction.

“Further work is needed to ensure alignment between scope, design development and cost assumptions in support of delivering the project within approved budgets. This provides an opportunity to refresh plans to ensure the project meets the needs of the community.”

–With files from Srushti Gangdev and The Canadian Press